VA DoT 500X 2007-2026 free printable template

Show details

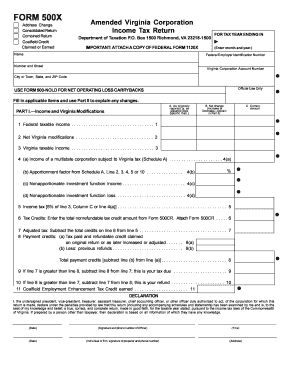

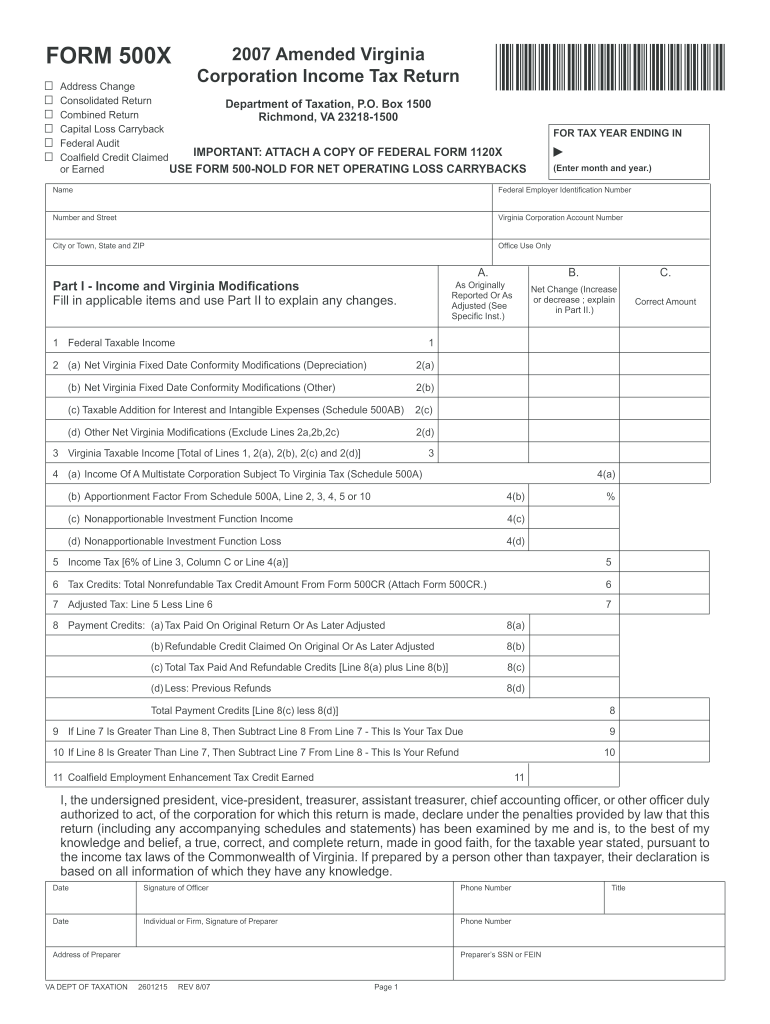

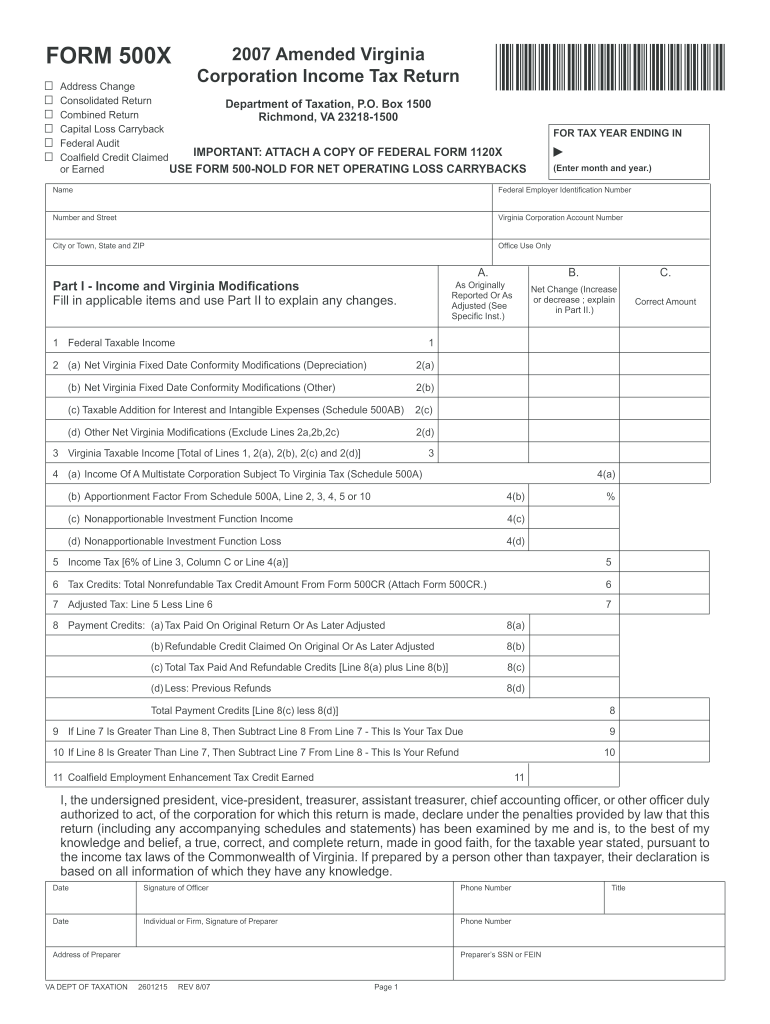

FORM 500X 2007 Amended Virginia Corporation Income Tax Return VA500X107888 Address Change Consolidated Return Department of Taxation P. General Instructions Purpose of Form Use Form 500X to correct your Form 500 Virginia adjusted by an amended return or an examination. Do not use this form for the carryback of a net operating loss use Form 500-NOLD Corporation Application For Refund. When to File File Form 500X only after you have filed your original return. Attach a copy of federal Forms...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign irs va withholding form

Edit your va withholding filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virginia 500x income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax filing include online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit va procedures filing form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT 500X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 500x

How to fill out VA DoT 500X

01

Obtain a copy of the VA DoT 500X form from the official VA website or your nearest VA office.

02

Fill out the applicant's personal information in the designated sections including name, address, and contact details.

03

Provide information about the service member's military history, including branch of service and dates of service.

04

Indicate the purpose of the application or claim and attach any necessary supporting documents.

05

Review the completed form for accuracy and completeness to ensure all required fields are filled out.

06

Sign and date the form before submission.

07

Submit the form via the recommended method (online, by mail, or in person) as outlined in the instructions.

Who needs VA DoT 500X?

01

Individuals applying for veteran benefits or services provided by the Department of Veterans Affairs.

02

Veterans seeking compensation, pension, or other forms of financial support.

03

Dependents of veterans who require benefits that fall under the VA jurisdiction.

Fill

form va 4

: Try Risk Free

People Also Ask about virginia va 4 form

How much is IRS revenue?

During Fiscal Year (FY) 2022, the IRS collected more than $4.9 trillion in gross taxes, processed more than 262.8 million tax returns and other forms, and issued more than $641.7 billion in tax refunds. In FY 2022, nearly 58.2 million taxpayers were assisted by calling or visiting an IRS office.

What if you owe the IRS over $100 000?

Owing over $100,000 in taxes can be terrifying. If you don't take any action, the IRS will issue a tax lien, and you will lose your passport. The agency may also garnish your wages, seize your bank account, and start levying your assets.

Where does the money the IRS collects go to?

As you might have expected, the majority of your Federal income tax dollars go to Social Security, health programs, defense and interest on the national debt.

How many taxpayers owe the IRS?

Some 11.23 million Americans owe a total of more than $125 billion in back taxes to the IRS.

What does IRS do with the money?

The Internal Revenue Service is a federal agency responsible for collecting federal taxes and enforcing U.S. tax laws. Most of the work of the IRS involves individual and corporate income taxes.

How much revenue does the IRS collect each year?

Fiscal Year 2019 State federal district or territoryGross collections (thousands of dollars)California472,027,235Colorado59,961,429Connecticut57,092,781Delaware20,073,97951 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute va tax forms 2025 online?

pdfFiller has made filling out and eSigning va 4 form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the virginia state withholding form 2025 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your va state tax form 2025 and you'll be done in minutes.

How do I edit virginia tax form va 4 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing virginia form va 4 right away.

What is VA DoT 500X?

The VA DoT 500X is a form used in Virginia for reporting the transfer of ownership for motor vehicles.

Who is required to file VA DoT 500X?

Individuals or entities that are transferring ownership of a vehicle in Virginia are required to file the VA DoT 500X.

How to fill out VA DoT 500X?

To fill out VA DoT 500X, provide the information required about the vehicle, including the owner details, vehicle description, and the date of transfer.

What is the purpose of VA DoT 500X?

The purpose of VA DoT 500X is to officially document the transfer of vehicle ownership and to ensure that the state records reflect the current owner.

What information must be reported on VA DoT 500X?

The information that must be reported on VA DoT 500X includes the names and addresses of the buyer and seller, vehicle identification information, and details of the transaction.

Fill out your VA DoT 500X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va 4 Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to va 500

Related to va 5 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.